Revisiting Organic Customer Acquisition After ATT

Learnings from Eric Crowley’s 2021 Report on Customer Subscription Software

David Barnard

When Apple announced the new “App Tracking Transparency” (ATT) policy at WWDC last year, it forced apps that relied heavily on paid customer acquisition to start rethinking their strategies.

In case you don’t know, ATT requires developers to request permission from users before accessing the IDFA or using any personal data to track them. While this was a welcome change for consumers — and has been praised by privacy advocates — developers were left with a lot of uncertainty about what this would mean for their businesses. It wasn’t clear when Apple would roll out ATT, how it would be enforced, and what percentage of users might opt out.

ATT went into effect in late April with iOS 14.5, but developers and advertisers weren’t able to gauge the true impact of this policy until the update gained mass adoption over the summer. And it hasn’t been pretty. Shares of Snap (Snapchat’s parent company) plunged 25% in October, and Facebook reported lower-than-expected quarterly earnings. Both companies specifically mentioned ATT as a major factor in missing their targets.

We recently chatted with our friend Eric Crowley, executive director of GP Bullhound, about Apple’s privacy changes and what they mean for subscription app businesses. (Check out the full podcast episode here.)

Eric has talked to consumer subscription software (CSS) businesses that have seen their customer acquisition costs (CAC) go up a whopping 20-30%. “It’s deprecated the ability for marketers to accurately target people using social networks, and it just means that marketing efficiency will go down, which can impact growth rates, conversion rates, and the financials of these businesses,” he says.

Since Apple rolled out ATT, app marketers throughout the industry have seen their targeting precision and conversion rates go down, increasing their costs to acquire subscribers.

Sounds dismal, right? Actually, Eric is pretty optimistic about the future. He thinks this is just a short-term problem and that companies will eventually adapt and see long-term gains.

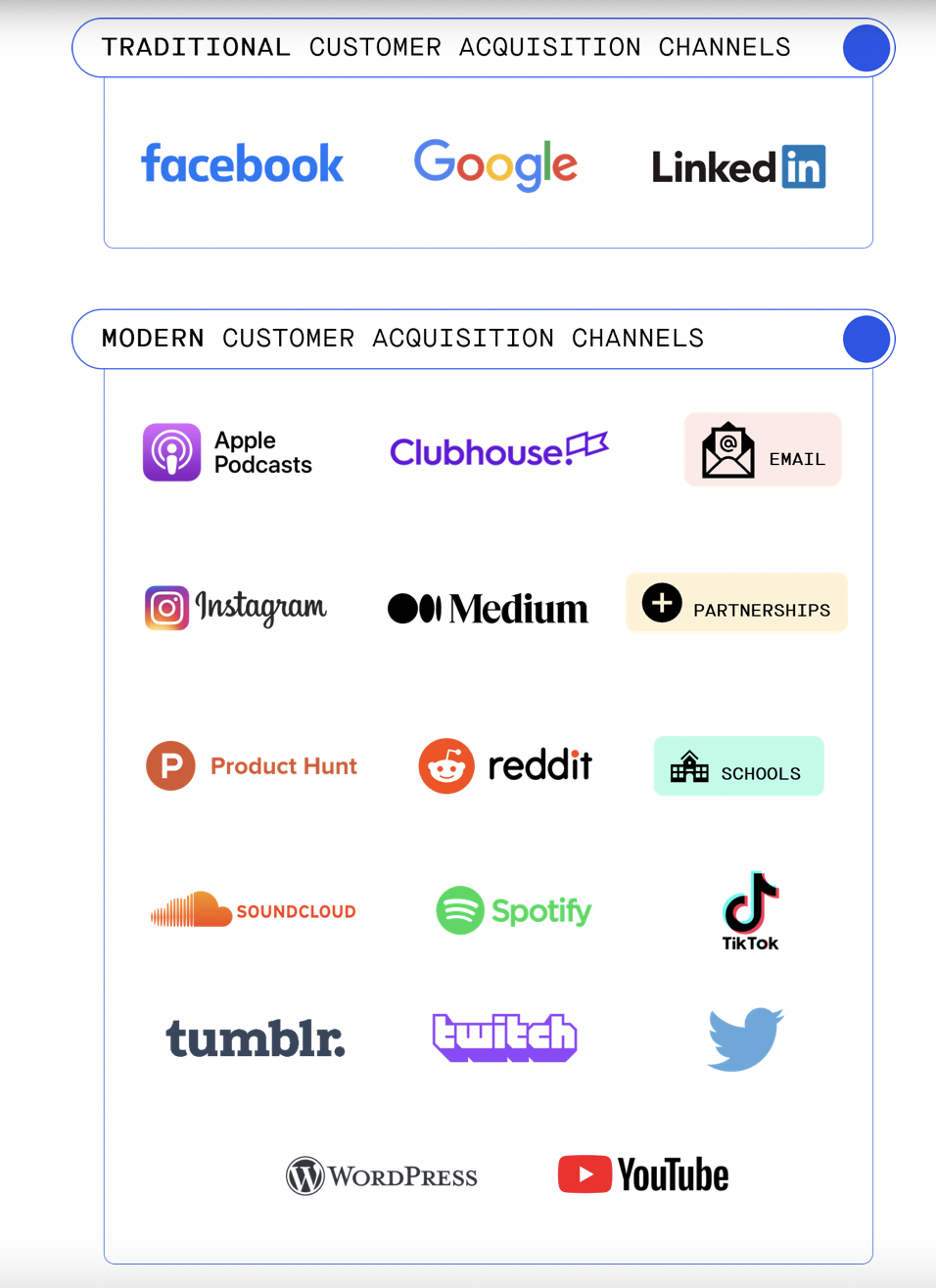

So what can app businesses do to adapt to the post-ATT world? Go back to app marketing basics. While downloads are often considered a vanity metric, acquiring free users can still be beneficial to your app’s bottom line. If you have a good freemium strategy in place, then ultimately even free users can turn into subscribers.

“It becomes a lot harder to find what you want — you’ll have much lower conversion and purchase rates, so it becomes more of a specialty situation. You’ll walk into a store just for outdoor gear and healthy granola, and ultimately that’s a lot better for companies in general in the long term,” he says.

Rethinking the LTV metric: Separating the locals from the tourists

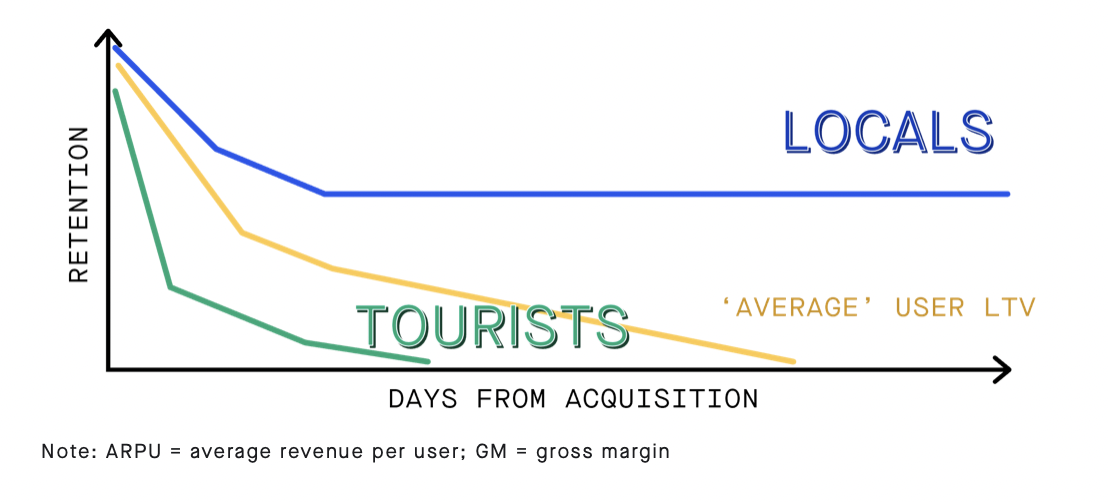

LTV is an important metric for subscription app businesses — it helps you determine how much you should spend to acquire a subscriber. It’s also a sort of health check for your business. If you’re charging $60 per year on average and have an $80 LTV, you can tell right off the bat there’s a major churn problem.

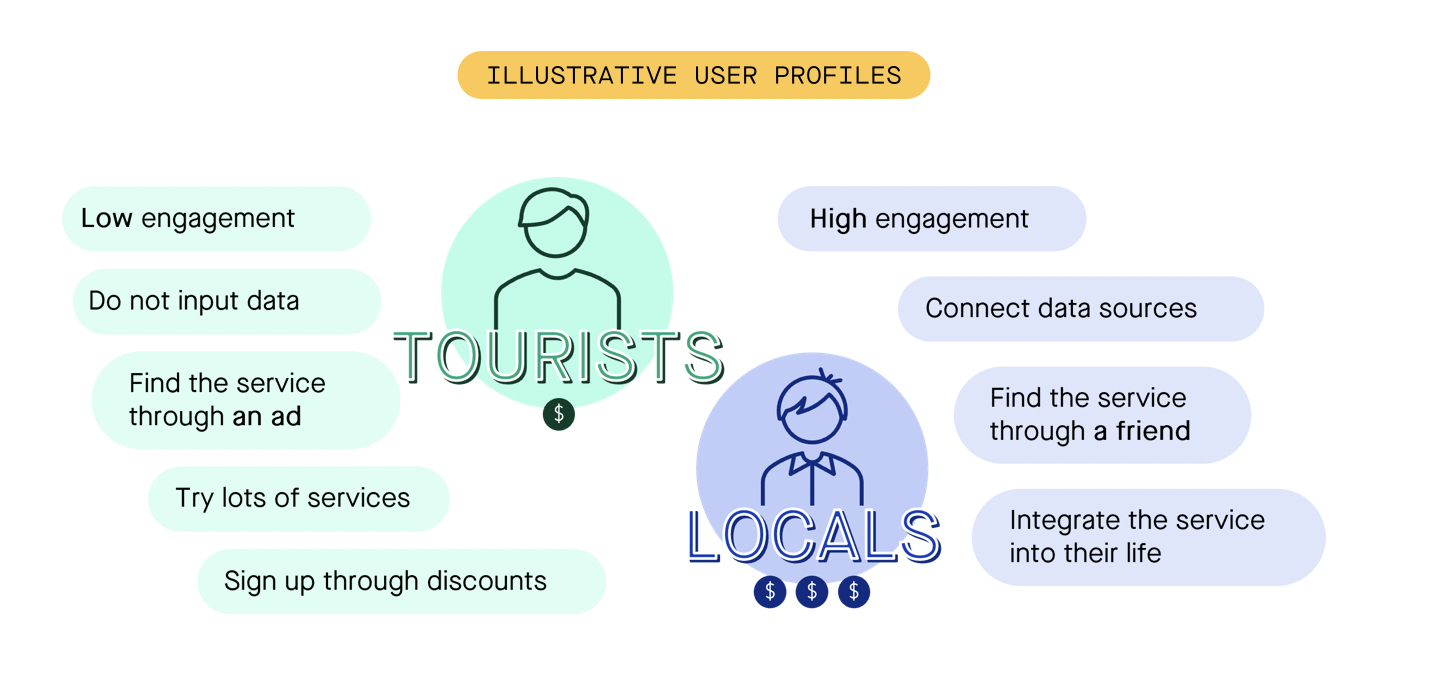

The problem with LTV, explains Eric, is that it’s derived from an average of dedicated paying customers (the “locals”) and those that aren’t as committed (the “tourists”).

Eric shared an example of a fictitious company to illustrate his point. Say you build an app that lets users track their walking activity. Of the 100 people who sign up to use it, 20 people walk every day — they’re tracking their movements and they’re getting a lot of value out of the app. Meanwhile, 40 people track their walking for a month or two, then switch to another activity like cycling or skateboarding. And then there are the people who signed up due to peer pressure; they don’t actually like walking and quickly churn.

The LTV is very different for each of these groups.

“So you need to find out who your locals are (the people that are going to use your app all the time, every day) and find a way to measure that. Because these are the people that contribute to your community, and they’ll make it more robust because they’re constantly contributing feedback,” explains Crowley.

“They’re also more likely to stick around, so you need to add the tools that they’re looking for,” he adds. For example, you could add a weather forecast to your app to create a one-stop shop for people who love to walk.

Ultimately, Eric says that if you can identify the locals and design your app and customer acquisition strategies to fit their needs, the LTV of that cohort becomes a far more valuable metric — and will more reliably show your app’s potential over the next 3-5 years.

In-App Subscriptions Made Easy

See why thousands of the world's tops apps use RevenueCat to power in-app purchases, analyze subscription data, and grow revenue on iOS, Android, and the web.