Subscription metrics: a guide for subscription apps

Measuring your subscriptions and understanding the mechanics behind them.

Analyzing a subscription business is not as straightforward as you might think. Selling as many subscriptions as possible may not be nearly as lucrative as having a steady number of users who never unsubscribe. Measuring your subscriptions and understanding the mechanics behind them will help you drive product decisions and forecast and grow revenue. In this post, we’ll cover the key subscription metrics you should monitor and what they mean for your business.

The Subscription Business Model

Before we dig into subscription metrics, let’s talk about the subscription business model. We all know that subscription businesses are based on recurring revenue, which gives you a more predictable cashflow — which is generally better for business.

However, charging for your app on a subscription basis comes with certain user expectations. Unless you continue to provide new content, updates, and recurring value to users, they are unlikely to stay subscribed for long and may even feel cheated by being sold a subscription.

Consider some of the top subscription apps, like Netflix, Spotify, and Tinder. If the content of these apps never changed, how would that affect subscriber rates? To make subscriptions work, you need an app that provides ongoing value.

To make subscriptions work, you need an app that provides ongoing value.

At a 10,000-foot view, a subscription business has two core mechanisms:

- Selling subscriptions.

- Retaining subscribers.

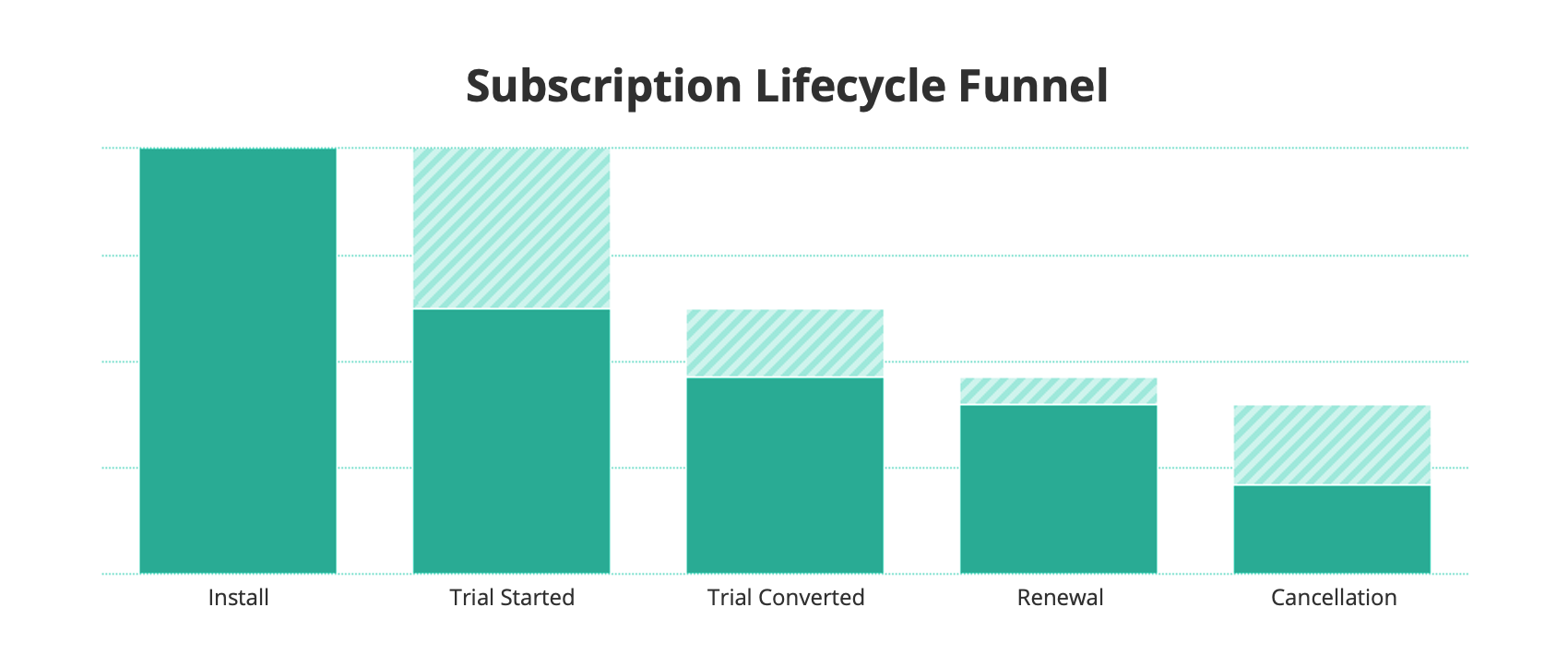

Improving either one will increase the revenue for your business. Improving both will exponentially grow your business. Every point between a user downloading your app and canceling their subscription is an opportunity to increase revenue. A funnel is a great way to visualize how many valuable users you can draw in. Here’s a typical funnel for a mobile app, which we’ll analyze further in a moment:

A Health Check On Your Business

Before diving into the funnel, let’s discuss a couple base subscription metrics that will help you decide later whether any of the changes you made actually improved your bottom line.

Revenue

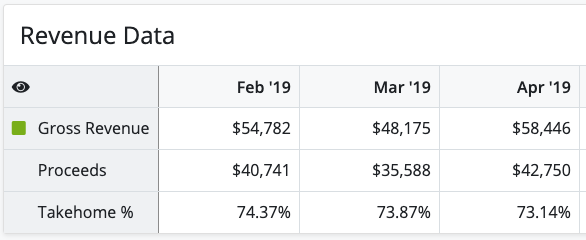

Revenue is how much money you are generating. However, revenue is not necessarily easy to track with mobile subscriptions. If your app offers a trial, revenue isn’t generated until the trial ends, and most of your revenue will come from recurring renewals. Because these revenue events occur regardless of whether a user actively uses the app, they must be tracked on the server side and independently of in-app usage.

In addition, because app store fees are notoriously high (30% or 15%), proceeds (or take-home percentage) should be broken out from gross revenue. This is especially important as your subscribers start to stay subscribed for more than 1 year and the 30% fee drops to 15% for some users. You’ll end up with a blended take-home percentage between 70% and 85% of revenue that could have a substantial effect on your cashflow.

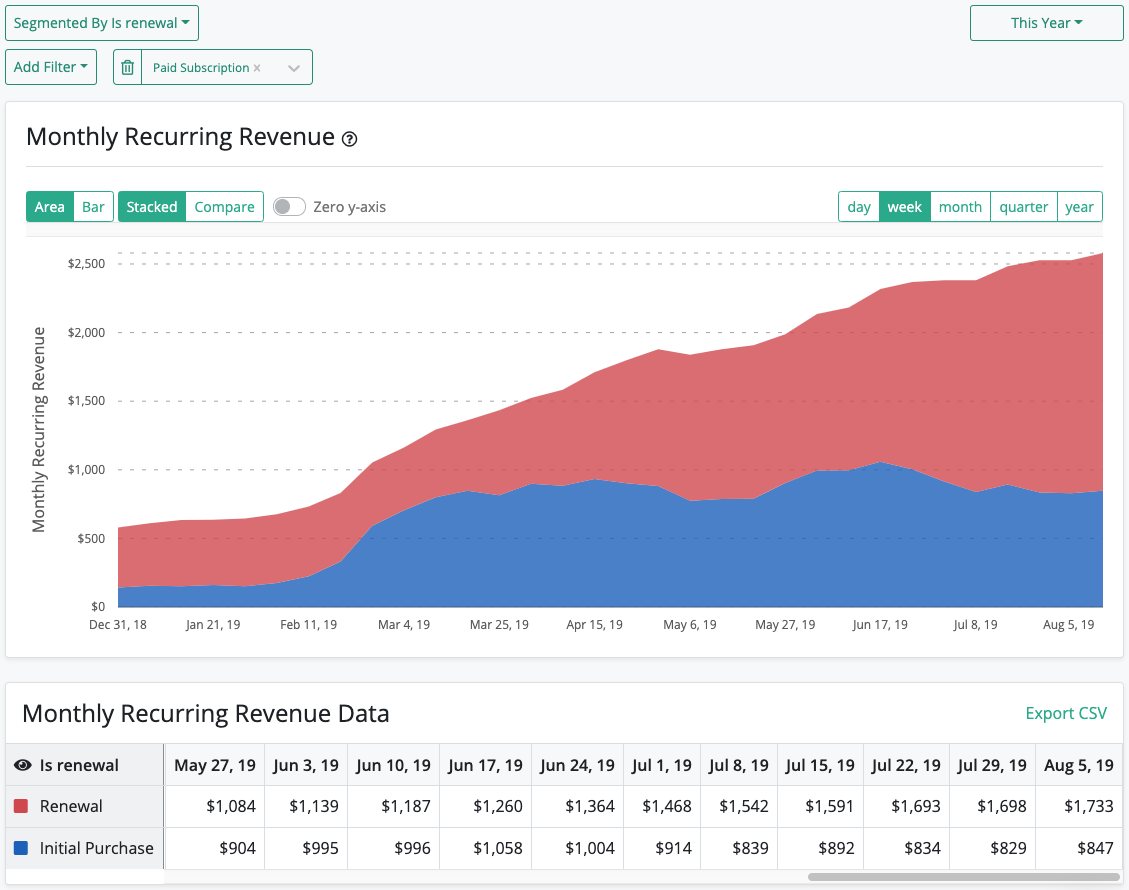

Monthly Recurring Revenue, or MRR

Possibly more important than revenue is monthly recurring revenue, or MRR, which is the metric subscription businesses cite most often. MRR is a benchmark of the size and growth of your subscriber base and your business. It differs from revenue in a few ways:

- MRR acts as a de-noising filter, giving a smoother picture of your business’s revenue trend. A smoother revenue trend is particularly useful for apps with multiple subscription durations (for example, monthly, annual, and lifetime).

- Apple and Google pay you all the revenue from longer-term subscriptions immediately upon purchase, which causes large spikes in revenue. These spikes can mask trends caused by shorter-term, lower-price subscriptions. MRR helps clarify those trends.

Although MRR is about monthly revenue, it is based on current active subscriptions and their durations, which changes from day to day. As such, MRR can be expressed as a daily metric, giving you a good overview of the trends of your business.

There’s no “official” way to calculate MRR (we used revenue normalized to a 28-day period). It’s more important to understand that however you calculate MRR, it is one of the best indicators of the overall health of your subscription business.

Install

Now that we’ve described how to measure the health of your subscription business, let’s get back to the top of the funnel: installs. The more users who install your app, the more subscriptions you’ll sell and the more MRR you’ll generate. Sounds simple. But before you pay for a billboard in Times Square to drive installs, it’s worth trying to identify any “leaks” in your funnel—obvious spots where users are dropping off.

Whether your app has 10 or 10,000 installs per day, the same funnel and subscription metrics apply. This isn’t a post about driving installs, but when the time does come to boost top-of-funnel growth, there are a few well-known tactics:

Virality

Virality means one user shares your app with another user, and that user shares it with someone else, and that user shares it with… you get the idea. The web is filled with information about viral strategies from referrals to shareable content and beyond. Viral growth is great because your users do the work for you and growth can be exponential.

Paid Acquisition

Paid acquisition is the most common strategy to drive installs among mobile businesses. If you can spend $1 to acquire a user who will pay you $3, and you can multiply that by 1 million, you have a serious business! We have a lot to say about paid acquisition and measuring results, or attribution, so watch for another post dedicated to the topic soon.

Trial Started

Free trials are such a common and effective way to sell more subscriptions that we’ve included it in our funnel. If you haven’t experimented with free trials and how they affect your MRR, it’s probably worth coming up with some way to give users a taste of your product for free before they commit to buy. On the other hand, free trials don’t work for every app—every business is different.

The goal at this stage is measuring how many users start a free trial of your subscription. Tracking this metric is usually straightforward because you can gather the data you need from in-app events. An important note: Be aware that some mobile analytics SDKs that claim to track in-app purchases automatically do not count free trials properly.

There is plenty of room to experiment with improving free trial start rates, and it starts as soon as users open your app. A great onboarding experience that explains your value proposition clearly is a must. This is your initial sales pitch to users, and it’s up to you to hook them in.

To get inspiration, download a bunch of the top-grossing apps in each category and find out what they do well with onboarding. Notice how long onboarding takes, the amount of text involved, and the user engagement tactics that these apps use to hook users in and sell their subscription plans. Then, incorporate what you learn into your own onboarding experience.

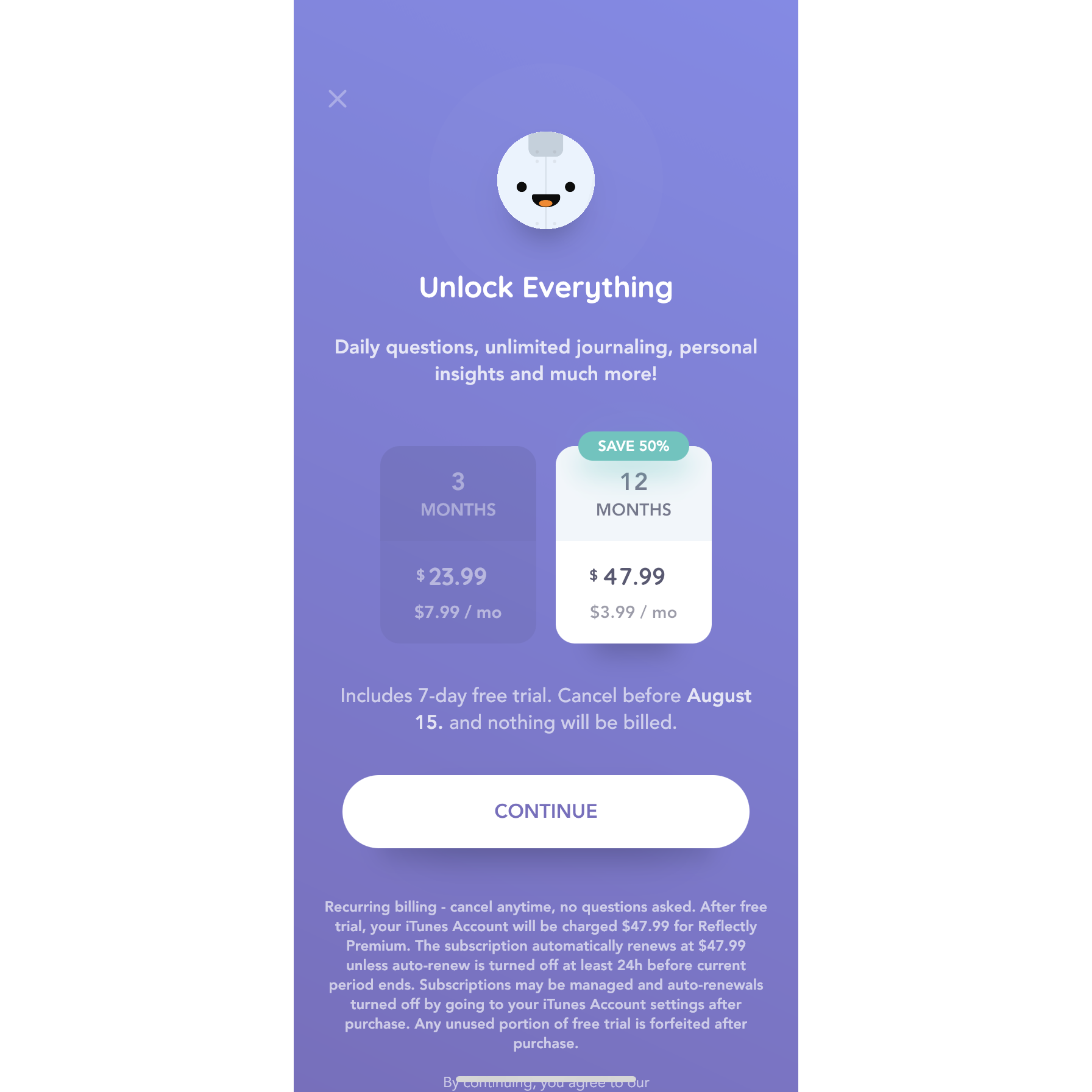

After a great onboarding experience, it usually makes sense to present users with the option to purchase a subscription. Even if you don’t require a subscription to use your app, some users will want to try your premium experience right away. This “upsell screen” is another great place for experimentation. Again here, you have plenty of options for presenting your upsell screen in ways that may increase your trial start rate.

If you only offer a single subscription plan (such as monthly), try offering one or two additional options with different durations and prices. Different offerings and prices have a big impact on a user’s willingness to pay. Different prices, trial durations, subscription durations, and even the amount and order of the options you offer can affect your trial start rate. For example, a $79.99 annual plan may make your $6.99 monthly plan seem like a deal.

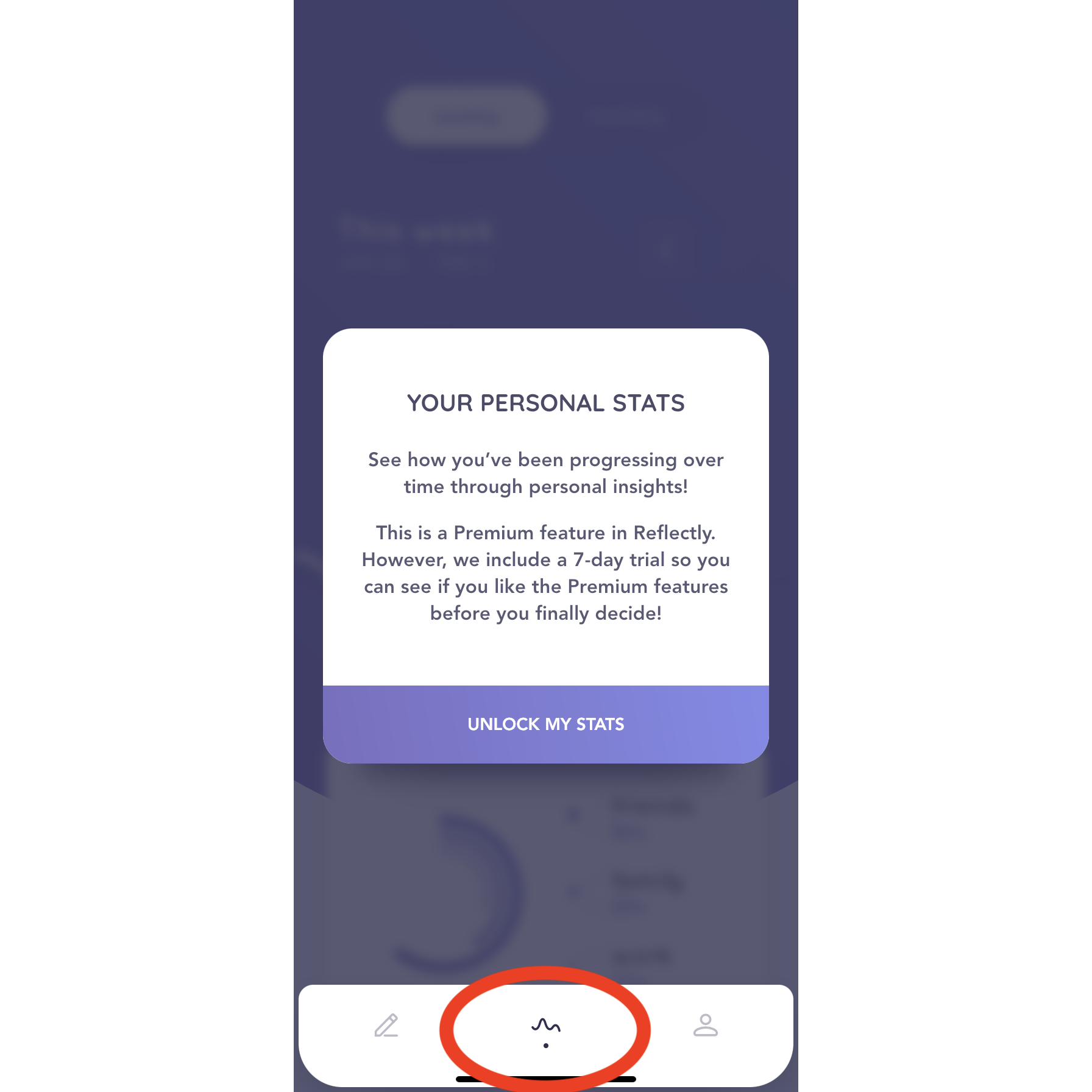

The upsell screen that you show after onboarding shouldn’t be the last place you offer a subscription to users. Some apps only have an “Upgrade to Premium” button buried in their app settings, which will definitely hurt their trial start rates. One pattern that works well is to show users your upsell screen whenever they try to navigate to a premium feature. Keeping the buttons and tabs that show premium content active for free users almost guarantees that they will try to navigate there, and they’ll be reminded every time that premium features are only available to subscribers.

More advanced experiments might include reducing prices based on how many times a user has been presented with the upsell screen. The possibilities for experimenting with your upsell screen are endless—if you’re going to run experiments, trial start rate is a great place to do it.

If you’re going to run experiments, trial start rate is a great place to do it.

Trial Converted

In our funnel, everything up to this point hasn’t brought in any revenue. In some cases, it may have even cost you revenue to get users this far (the cost of acquisition). But now it’s time to see how many of those trial starts you worked so hard for are converting to paid users. Trial conversions (and the rest of the funnel after this point) can only be measured accurately on the server side. This is because trials convert through the app stores automatically and independently of any in-app events you could track from the device.

Trial conversion will vary based on trial duration and how much users depend on the premium features of your app. A trial conversion rate of 33% is a good baseline to start with. Conversion rates can go much higher if you can get a targeted audience to start free trials.

There’s usually less room to experiment with improving trial conversion rates than with improving trial start rates, but you should still measure both. Your ultimate goal is MRR, so a high trial start rate means nothing if users aren’t converting.

You can draw some insights based on when users opt out of converting their free trials. Is it right away, after seeing premium content for the first time? Or is it later, just before the free trial converts? This information can help you identify where to focus: providing more value initially or more value later.

Also, note the number of subscriptions that start without a free trial. The app stores only allow users to redeem a free trial once. If users subscribe again after canceling a trial, they go immediately to a paid subscription. If your app has a high percentage of subscriptions that start without a free trial, that means your users cancel their trials and come back to pay. Experiment with offering a longer trial period to see if that helps convert more users.

Renewal

Renewals are the money-maker in the subscription business model. Your goal is to keep subscribers renewing for as long as possible, which directly improves your MRR. Any revenue you generate from renewals is revenue that you still get even with zero new installs—that is the magic of subscriptions! Instead of thinking about increasing the number of renewals, it can be more helpful to think in terms of reducing cancellations, which we’ll discuss next.

Cancellation

Cancellation (or churn) is the rate at which users unsubscribe from your app. Churn can happen when users are in a free trial period or after any number of renewals. The average churn rate in the mobile app business is usually substantially higher than in the B2B SaaS world. On the low end, churn is 5% to 10%. On the high end, churn can be more than 30% every month.

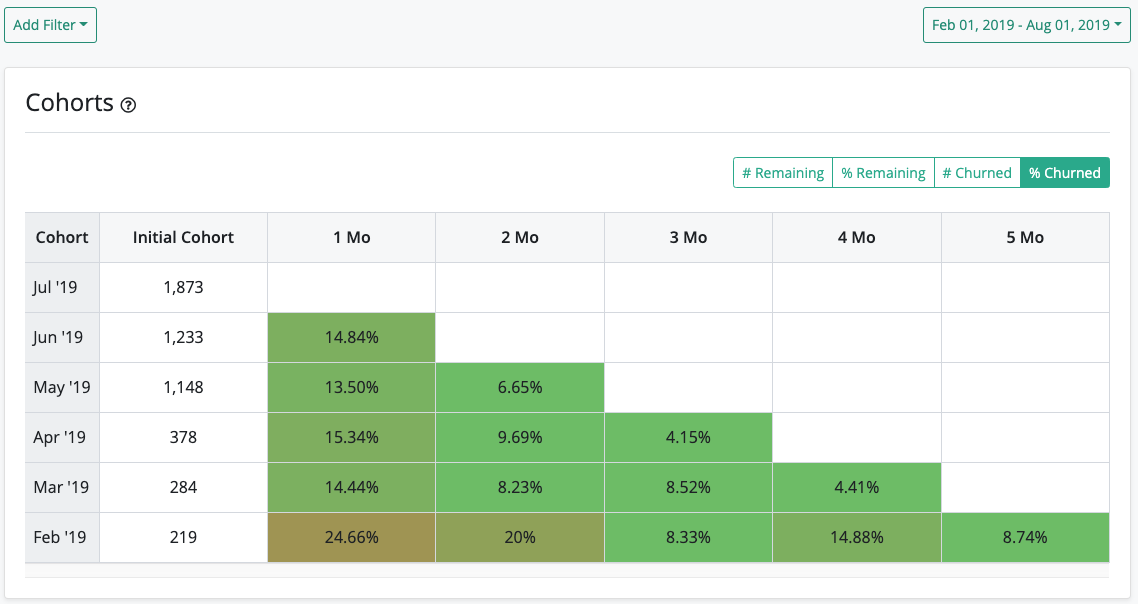

When analyzing your churn, look at when users are churning in their lifecycle. Is it after their first renewal or their tenth? A cohorts table is useful for spotting trends in churn and monitoring whether churn is increasing or decreasing over time.

You’ll notice that churn tends to be higher with the first renewal and gets lower with each consecutive renewal. This is because the longer users are subscribed, the less likely they are to churn. Watch out for periods where churn is much higher than in the previous period and find out if something happened during that period to drive the increased churn.

Voluntary vs. Involuntary Churn

Most of the churn we think about is voluntary churn. This churn is from users who choose to cancel on their own. But there’s another type: involuntary churn, which happens when subscriptions are canceled but not by the users. Involuntary churn potentially accounts for approximately 20% of all cancellations.

The involuntary churn you’re most likely to experience with your mobile app is billing issues. If the app stores are unable to charge users for their subscriptions, they will be canceled. This is an opportunity to increase your MRR by helping users resolve billing issues before their subscriptions are canceled. One technique is to notify users through email, push, and in-app messaging when the app stores detect a credit card problem. If you can help half of these users resolve billing issues before their subscriptions are cancelled, you could reduce your overall churn by 10%!

For voluntary churn, you can try user engagement strategies like feedback surveys to collect information about the reasons for cancellations and drive product features and promo codes to encourage resubscription.

Refunds

The worst form of cancellation is probably a refund. Not only do you lose the subscriber, you lose any revenue from the subscription too. It’s important to at least track refunds to make sure a substantial portion of your cashflow isn’t being returned to users. Ideally, the revenue and MRR metrics you track will already account for any refunds.

Where To Go From Here?

At minimum, you should start collecting these subscription metrics for your app (if you don’t already). It will only get more difficult to retroactively generate analytics as more users install and subscribe to your app.

Setting up a funnel puts you in a great spot to understand the dynamics of your subscription business and how you can improve it. There may be a few obvious places to start that will improve your MRR. Experimentation is your friend, and incremental improvements compound over time in the subscription business model.

Remember, when experimenting to improve a particular metric, always step back and think about the effect it has on your business as a whole. All of these components work together to drive MRR.

If this post is helpful or you have an idea for a topic we can cover next, we’d love to hear about it! Head to our Community or send us an email. We are available to help you in any way we can, so don’t be shy about reaching out.

For more updates, tips, and tricks, follow us on Twitter!

You might also like

- Blog post

The complete guide to SKAdNetwork for subscription apps

Understanding Apple's privacy-first attribution

- Blog post

“A big market is great only if you can take a substantial share of it” — Patrick Falzon, The App Shop

On the podcast: estimating the revenue potential of an app, crafting an exit strategy, and why LTV is such a terrible metric.

- Blog post

Effective testing strategies for low-traffic apps

Is A/B testing off the table? Let’s rethink experimentation.