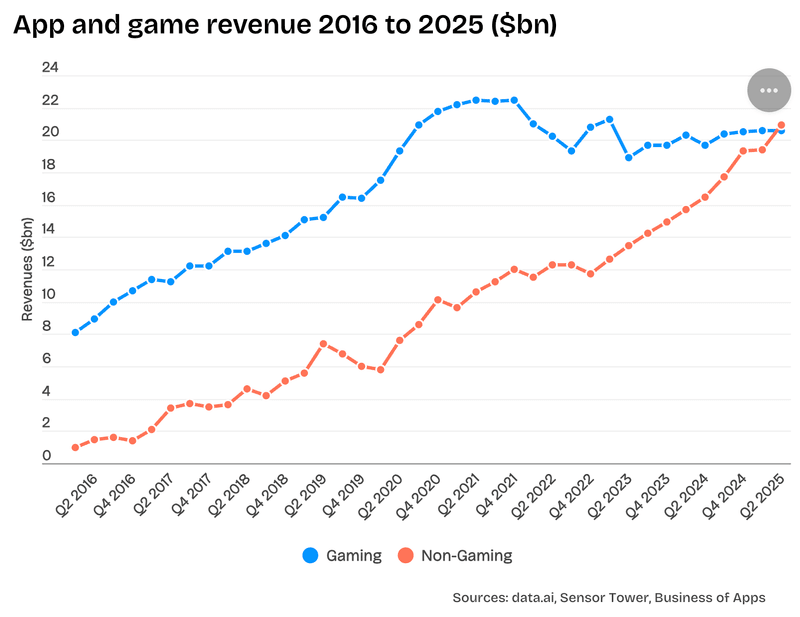

This headline has recurred regularly over the last couple of years, as the few app intelligence companies adjusted their timeline. Most recently it resurfaced in a Business of Apps piece claiming consumer app revenue surpassed gaming for the first time in Q2 2025 (see the cover image above).

I wanted to offer further perspective on what those numbers actually reflect.

Non-gaming growth isn’t new

I’m not disputing the overall outcome: revenue from non-gaming has been outgrowing gaming for several years now. Especially post-Covid, as gaming revenue largely stalled while non-gaming keep soaring.

This trend has been evidenced by the growing interest in subscription apps from actors historically focused on gaming, such as venture capitalists, ad networks, new tools, or exiting gaming founders launching app studios.

Yet, there are many nuances to take into account behind the top line figures that I’d like to highlight.

Market differences matter

The split apps/games revenue is very dependent on countries. In the US or India, it’s been three years now that the headline applies.

While some other markets heavily skew towards gaming, like South Korea (73% gaming in 2024!), Japan (67%) or Germany.

A few giants dominate non-gaming revenue

Aggregating all non-gaming revenue hides extreme power-law effects. The top 1% of publishers generate 90%+ of the stores revenue. The big revenue drivers are Social & Entertainment (Tiktok, HBO, Disney+, Youtube…). The overall revenue figure is more representative of the situation of a few big leaders than one of the hundreds of thousands of independent developers who read this news.

Where do we draw the line between apps and games?

What really defines a game versus a consumer app? There are many shades of grey between the category. I personally consider apps like Duolingo, Impulse, Toca Boca and Elevate to be games, miscategorized in “Education”.

Revenue figures have big blind spots

Keep in mind those revenue figures are:

a) Estimates, not real.

b) Only via in-app purchases (IAP) from the two main stores. This leaves aside a lot of apps & games revenue, especially in-app advertising (which I read was actually bigger than IAP, and is largely game driven) but also ecommerce, mobility/delivery, B2B, partnerships and more.

Apple shared two studies from the Analysis Group showing that more than 90% of the billings and sales from apps where going outside of IAP ($1 trillion+ from physical goods and services, $150 billion from in-app advertising, and $131 billion for digital goods and services – only the latter being reported in store revenue).

Off-store monetization is growing fast

Last but not least, in the last few years, there has been a fast growing trend of monetizing partially off-store, both for games (web stores, especially for VIPs) and apps (CRM & web2app for quite a while, app2web more recently). This revenue isn’t accounted for in estimates, and it’s currently close to impossible to understand how much hidden app revenue is generated there. Some big apps make the bulk of their revenue outside the store. Think about Noom, Netflix, or Gmail, for entirely different reasons.

A shift that’s real, but less clear-cut than headlines suggest

All in all, the tailwinds are strong for consumer apps (i.e. non-gaming), while mobile gaming is going through tougher times post-Covid. This shift is real, but it’s not exactly new. There is no precise way to determine at which moment the shift happened, if it even mattered at all, beyond serving as good engagement bait.