Tell me, what’s your niche? If you just said something like “women between 20 – 40” or “people who love to work out a lot,” please excuse me while I smack my head against the desk. I’m not criticizing you specifically, as this is a very common mistake, but one that is detrimental to your brand.

This isn’t a niche. This is far too broad to be a niche, and a result you’ll struggle with messaging and focus, as you’re trying to speak to everyone. When you don’t have a clear niche, it leads to vague and broad messaging that doesn’t actually resonate with anyone. It tends to lead to poor results like:

When I say the results, I’m referring to a lower click-through rate and lower conversion. Plus, this vague and broad messaging will end up increasing your cost of acquisition. So you’re spending more but getting less, which is not a great combination.

I always urge brands to zoom in on a niche. Because when you double down on a niche, it leads to far stronger performance. This group is often bigger than you expect, and even with a smaller audience, it will still allow you to bring in more customers because you’ll get better engagement. You’ll be speaking directly to fewer people rather than shouting at a massive crowd. For example, a financial app is focused on supporting potential first-time home buyers with saving enough to pay for their down payment, or a coding app is focused on teaching those who want to switch to being a front-end developer the basics of HTML, CSS, and JavaScript. Note that neither says anything in-terms of demographics but focuses on what they are trying to achieve by using your app.

However, I can admit that at a certain point, you’ve gotten all you can out of that group, and it’s time to expand. But how do you work out if it’s time to branch out? How do you achieve this without running the same risk as being niche-less? What are some of the risks to watch out for? Let’s find out.

How do you know when it’s time to scale to a broader audience?

The first basic check is the back of the napkin calculation. You don’t need to grab an actual napkin for this, but you might want to open a new document. I want you to consider the following questions: how many people match your niche? What percentage of that have you acquired? For this, I tend to rely on online statistics (rather than a napkin and pen), and I research specific characteristics to determine who our niche is.

Imagine you are focused on women struggling with menopause symptoms in the US. You’d want to work out not only how many women are going through menopause but also narrow it down to the main markets in the US where you seem to have a strong LTV and also down to which percentage have worse symptoms that impact their lives.

That’s not all. From there, you look at the relative percentage you have. What saturation looks like will depend a bit on how competitive the market is. If you have a vast range of competitors or larger competition, your ceiling might be 2-5%. In contrast, with an untapped market, it may be 5-10%. I don’t tend to go much bigger than that because there is always some form of direct or indirect competition, and not everyone who is problem-aware is looking for your type of solution.

Here are some more signs that it is time to scale to a broader audience:

- You have strong retention in your existing niche, meaning you’ve gotten most of what you can out of it in terms of lifetime value.

- You have 2-3 channels working effectively to acquire customers.

- You’ve tried multiple attempts to scale those channels, including different angles to speak to that niche, but haven’t seen any success with it.

What are the best strategies for market expansion?

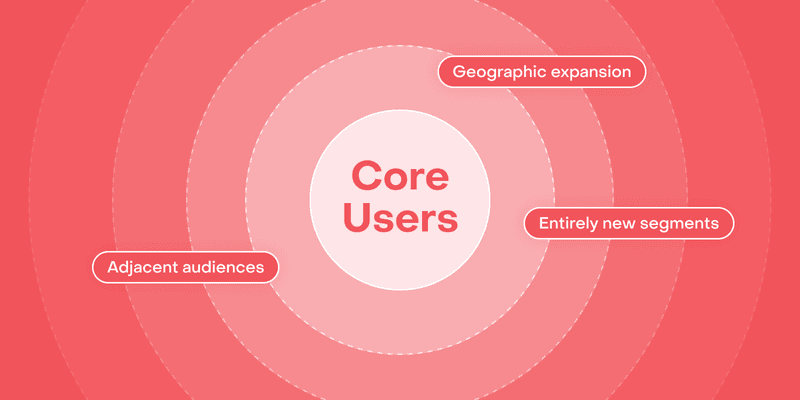

We’ve covered the signs that it’s time to expand your niche and what a niche actually is, but what’s next? Once you’ve decided it’s time to scale to a broader audience, you still need to work out the right approach. We’ll walk through three different methods and for whom each one is most relevant.

Option 1: Similar audiences with similar needs

One way to expand on this is to identify similar audiences with similar needs. You focus on how to slightly widen your niche definition to scale up. It’s not about finding a new group of people, but including a few more that you didn’t before.

With this, you don’t focus on a secondary JTBD but rather try to think of who else could have similar needs or how to speak to people earlier in terms of their awareness level. Right now you’re focusing on the easiest section, where people are aware, but now you’re going to edge slightly further to the unknown.

Let’s return to the menopause example. This brand might focus on women who are more unaware of the fact that their symptoms are caused by menopause or that they are already going through menopause. They need you to tell them that.

Most brands focus on those that are product aware, maybe solution aware, rather than using broader language and awareness to attract those in the problem awareness phase. This naturally brings in slightly different users.

This works well if you have strong brand awareness channels, as those earlier on in the funnel will often need more time to convert as their journey is longer. When I first started working at Heights, a subscription business focused on brain supplements, they were initially focused on teaching everyone what braincare was and why supplements were beneficial. This wasn’t an effective strategy initially because it was a long journey, and we needed to speak to those ready to buy (and as a startup, you can’t get away with waiting a year or two). But in the long-term, building that audience and email list drove subscribers later down the line, as once they were at a later phase, they were ready to buy.

With similar needs that your product also solves, you can work this out through JTBD user interviews. Focus on speaking to the high spenders and seeing what differences exist between users. This will give you additional ideas and insights into how to expand it.

This is often the safest technique to expand your audience and likely the one you may have already been doing, but eventually, if you want to grow faster, you’ll need to turn to options two or three.

Option 2: Identify other market segments you can also effectively serve

This is similar to the first option, but instead of further expanding your existing market, you’re focusing on a very different market segment with different needs and different customers:

Let’s circle back to our example of a menopause app, which might focus on those going through peri or post-menopausal symptoms who would also benefit from the brand. Or it may be a complete tangent of supporting women struggling with pregnancy-related hormonal symptoms.

With this option, it can also be a very different problem that your solution also solves. Let’s use Calm as an example. In the early days, Calm was created as a meditation app, and the majority of its users came to it due to sleep issues. However, the results of their onboarding survey highlighted that a large group of people were also turning to Calm because they were struggling with stress and anxiety:

This is a golden insight, and one to further chip away at. From there, you can see which of those users are spending the most already (even if their LTV is currently slightly less than sleep) and conduct interviews with them to see how to serve them better. You can then also expand your marketing to focus on them as well. If these users benefit from your app for that reason, then others likely will, too.

But this approach comes with risks, namely that your marketing may become very broad and no longer speak to your initial niche. It’s also essential that the audience’s needs are similar enough to your original one so that you aren’t, in essence trying to build two apps into one. It can’t come out of nowhere and needs to originate in your product/service.

An interesting example of this is BetterMe. They have two apps rather than one: one focused on health coaching, and the other focused on mental health. Though both help their target audience with their health and well-being, they saw that the needs and requirements differed for those focused on their physical and mental health. It couldn’t be a case of one-size-fits-all despite how similar those two services may seem. I think this is a better approach than trying to force two different use cases into one app, as the end result is messy.

Option 3: New geographical regions

The third option is the one most commonly considered when brands are thinking about expanding. They think it’s easy, especially with an app where you don’t have the same hassles of supply chain issues you can have with a D2C brand. Many barely discuss the decision and just roll out their app in new places. Simple fix, right?

Not so simple. In my experience, you should be cautious in assuming your niche will be the exact same in different geographical regions. We’ll discuss some of the challenges and risks to keep in mind.

That being said, this can be a great approach to expanding your niche, especially if you see the following signals:

- Organic adoption from those regions/countries. If you are already seeing people adopt from those regions/countries despite not focusing your market efforts, this could be a sign of initial interest. However, don’t just look at the app stores for download rates, but also use your analytics to see if they’re engaging. There’s no point in an app that never gets used. Now, it’s unlikely the engagement will be the same as your initial niche, but you should see some hints of interest.

- Relevancy of niche there. Each region/country will display cultural differences as well as varying market maturity. Now, this can be hard to gauge, but in general, search volume (e.g., Google Trends, App Radar) can give you an idea of how this compares to your market, as well as the number of competitors. The best understanding, though, always comes from speaking to (potential) users within that market. Yep, I’m recommending user interviews, as always.

- A gap in the market in terms of (local) competition. It’s a bit of a win-win or lose-lose, depending on whether your glass is half-empty or full. No competition could mean a lack of maturity or relevancy in that market, but too much competition may make it hard to break through. You want to be looking at the local competitors and whether there are gaps they aren’t fulfilling. Also, find out if users are not fixed to a local competitor, e.g., some countries strongly prefer local brands.

Expanding geographically is great if you face increasing costs in your current market and see the above signals of interest. It allows you to expand your niche while staying focused on (mainly) the same features that drive value.

But first, here are some things to consider before expanding your geographical market:

- Have you considered local regulations? Now, this isn’t just for more typically regulated industries (e.g., gambling); local regulations can make it difficult to break through. For example, Duolingo encountered issues with entering the Chinese market, and while they eventually did launch there again, it initially stalled growth.

- Does your price model match your willingness to pay? While you can localize price per market through the app store, it has to make financial sense. For example, if that market’s willingness to pay is so low that you can’t afford to spend to grow in that market it might not be the right step. Reviewing competitor pricing will give you a general indication of this (though it should not be the sole deciding factor in your pricing strategy).

- Your product-market fit may differ. I hinted at this earlier, but it’s worth repeating. Although you are probably focusing on a similar JTBD, don’t forget that markets will still vary in terms of what they find essential, as their values and the competition will differ.

- You need to localize the experience. Not only will PMF be different, but often, the ad creatives needed will differ, as will the language needed, etc. It’s more than a copy-and-paste translation job; I’ve found that you’ll require local knowledge within the team to succeed.

What are potential pitfalls to avoid when expanding your market?

Let’s be realistic, anything that is a more prominent strategic move comes with potential risks. But that doesn’t mean you have to fall prey to these pitfalls, as with the right preparation, you can expand your market without issue. Here are some of the most common pitfalls that I see happening in the attempt to expand beyond an initial niche:

1. Neglecting market research

With every single option to expand your niche, I’ve mentioned a key recommendation: talk to (potential) customers. This is something I’m always harping on about, but for good reason. It’s easy to get excited and just use what you know, but this audience is different otherwise you wouldn’t be expanding in the first place. Don’t assume what works for one will automatically work for the other, even if they seem “similar enough.”

If you don’t conduct thorough research, you end up with strategies, messaging, and offers that often fall flat and feel a bit tone-deaf to the market. We’ve all seen brands make this mistake and wince on their behalf.

The solution is simple: speak to your users. Conducting JTBD interviews can help you understand where they differ and, where possible, adjust your approach to suit the audience. For example, you might introduce a different tier in terms of pricing to meet their needs better or offer different features for certain markets or needs.

2. Diluting your core value

This is a risk that is even bigger with the first and second methods of expanding. If you end up continuing to grow your niche or trying to speak to new audiences, you can accidentally alienate your original user base. Don’t lose your loyal fans searching for new ones!

For this, I recommend being very conscious of your app storefront and keeping it suited to the most important group. From there, you can use Custom Product Pages (iOS) & Custom Store Listings (Android) to personalize where new potential customers land. Apple allows up to 35 custom product pages, each with different screenshots, videos, and messaging. Google Play lets you create custom listings based on location, user acquisition source, or other criteria. It’s truly that easy.

From there, I also recommend testing and adjusting your onboarding flow in-app to be personalized to them rather than trying to keep it broad. We see this with many larger apps; if you select a certain goal within the app, the follow-up questions will be completely different. If you indicate sleep as an issue with Calm, you go through entirely different questions:

Compared to if you selected reducing stress and anxiety as your JTBD:

The flows are quite similar, but they feel very personalized to the goal you indicated to Calm. It’s a win-win situation, as it allows them to tailor the initial content afterward. When you are working with different JTBD (as is often the case with Option 2) you want to ensure the onboarding flow helps identify who they are and what content within the app is relevant for them.

3. Overextending resources

As you’ve undoubtedly gathered by now, expanding your market isn’t a simple and easy task. Scaling requires significant investment, so it is vital that you ensure that your company has the financial and operational capacity to support expansion without compromising existing services.

So try not to tackle all three of the above at the same time, but rather see which has the priority for you based on the signals you are seeing. Don’t try to tackle three new niches at a time, but rather really focus on one at a time. Take slow steps to ensure you don’t fall flat on your face, as I’ve seen this happen too often.

4. Underestimating competition

A new target market will come with new competition. Even if you are focusing on an alternative local market, the fact that you are serving a new need will mean new competitors. It’s like taking on a new opponent in the boxing ring. It’s crucial to understand the competitive landscape and clearly define how your app stands out—-aka how you’ll get the knock-out.

Once again, it’s no surprise that I’m going to recommend speaking to users in that niche. I like to ask them the following:

- What solutions are you currently using to solve this problem?

- What do you like and dislike about each solution?

- What has led you to switch solutions in the past?

This helps you to remap your positioning versus those of your new competitors to understand where and how to stand out.

Are you ready to branch out?

It may be time to expand if you’ve seen the signals that you are hitting that niche ceiling. Maybe you need to widen your scope or at least shift direction slightly. With the three options I presented, I always recommend brainstorming based on data on what the opportunities would be per area. You’re choosing between:

- Similar audiences with similar needs

- Identify other market segments you can also effectively serve

- New geographical regions

And then prioritizing them based on the following:

- Amount of signals you see for the potential there

- Size of the potential addition niche

- What matches your current setup and resources best (e.g., serving a secondary English-speaking audience may be easier than focusing on a different market segment)

As you’ve seen with all three methods presented, customer research is crucial. Too many brands jump straight to the “let’s just test it” phase and waste valuable resources as a result. I won’t claim that user interviews mitigate all risks, but they will help you get closer to understanding what matters. With the right thought process, planning, and data, you can expand your niche and find more dedicated fans for your brand.